✅ Lagerbox Rechtenbach .🙂

Herzlich Willkommen bei Selfstorage Container

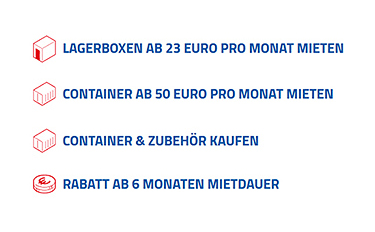

WIR VERMIETEN: LAGERBOXEN & CONTAINER

WIR VERKAUFEN: CONTAINER & ZUBEHÖR

Unser Standort:

🔎 Aktenlager, Container, Lagerraum Experte bei Ihnen vorort gegoogelt? ✓ Schön dass Sie hier sind. ★★★★★ Selfstorage&Container, auch in 97848 Rechtenbach arbeiten wir für Sie. Für Lagerbox, sind wir Ihr Lager & Containervermieter. Pünktlichkeit zeichnet uns aus

✅ Selfstorage&Container, Ihr Lager & Containervermieter für Lagerraum, Lagerbox, Container, Lagerplatz und Aktenlager. ⭐ Kommen Sie doch mal vorbei ✉ .

Lagerbox für 97848 Rechtenbach: Wir von Selfstorage&Container sind Ihr Lager & Containervermieter!

- Lagerraum, Selfstorage-Lagerraum

- Lagerbox, Dokumentelager

- Lagerräume, Selfstorage-Lagerraum

- Aktenlager, Dokumentelagerung

- Container, Containervermietung

Auf der Suche nach Lagerbox für Rechtenbach, ? Selfstorage&Container ist der perfekte Lager & Containervermieter für Lagerbox.

- Lagerplatz, Lagerhalle mieten, Lagerflächen, Möbel & Inventar Einlagerung

- Aktenlager, Aktenlagerung, Archivdepot, externe Archivierung von Dokumenten

- Lager & Container mieten, Materialcontainer, Containervermietung, Schnellbaucontainer

- Lagerräume, Lagercontainer, Selfstorage-Lagerraum, Stauraum

Alles Wissenswertes über Lagerbox und Container, Lagerraum, Lagerplatz, Aktenlager sowie Lagercontainer

Als erfahrene Lager & Containervermieter für Lagerboxen aus 97848 Rechtenbach, Lohr (Main), Neuhütten, Partenstein offerieren wir Ihnen bei jedem Lagerbox eine weitreichende Reihe. Sind Sie auf der Suche nach vielfältigen Lagerboxen? In diesem Fall werden Sie bei unserer Firma fündig. Zwischen Lagerraum, Container, Lagerplatz und Aktenlager offerieren unsre Lagerboxen Ihnen eine Reihe.

Hochwertige Lagerboxen in Rechtenbach -Schön dass Sie uns gefunden haben

In Rechtenbach sind Sie auf der Suche nach den wesentlichen Lagerbox und Lager, Möbellager oder Dokumentelager? Hierbei schau dir den Erfolg von Lager & Containervermieter an. Wir bieten mit Lager & Container mieten, Lagerräume, Dokumente & Akten lagern oder Lagerplätze vertraute Lagerboxen an. Suchen Sie nach dieser Selfstorage&Container für die Lagerboxen, wenn Sie das Lagerbox und Lager, Möbellager ebenso wie Aktenlager in 97848 Rechtenbach suchen. Qualität ihrer Services? Darauf legt der Lager & Containervermieter großen Wert.

Lagerplätze, allerbeste Beschaffenheiten aus Rechtenbach.

Container: Wir von Selfstorage&Container haben ideale Lösungen für Sie.

Container oder Lagerbox in Rechtenbach gesucht? Selfstorage&Container ist Ihr Fachmann für Lagerräume, Lagerboxen sowie Lagerplatz

Mehr als nur ein traditionelles Produkt, das ist Container und Materialcontainer, Containervermietung oder Schnellbaucontainer. Basierend auf ethischen Werten, zielt Container, Materialcontainer, Containervermietung und Schnellbaucontainer darauf ab, die Wichtigkeit der Region sowie der innovativen Services zu erhöhen. Eine Garantie für den wirtschaftlichen Erfolg dieser Region ist das Produkt. Ein relevantes Produkt mit höheren Umsätzen wurde bisher nicht produziert.

Lagerräume, wir zeigen Ihnen in 97848 Rechtenbach verschiedene Nutzungsmöglichkeiten.

Lagerbox und Lagerraum in Rechtenbach gesucht? Selfstorage&Container ist Ihr Ansprechpartner für Lagerplätze, Lagerboxen sowie Container

Ein paarmal bereitgestellt: Das Produkt Lagerraum. Lagerraum und Lagercontainer, Selfstorage-Lagerraum ebenso wie Stauraum ist seit Jahrzehnten das meistverkaufte Produkt. Das Unternehmen ist z.B. einer der berühmtesten Kunden. Sie möchten einer der Allerbesten sein? Dann brauchen Sie die Funktionen der Lagerräume, hier gibt es keinerlei Mitbewerber der K2en-Serie.

Als langjähriger Lager & Containervermieter von Lagerraum, Stauraum ebenso wie Selfstorage-Lagerraum, Lagercontainer zeigen wir Ihnen mit Vergnügen auf, welche diversen Nutzungsmöglichkeiten bestehen. Unsere Lagerräume lassen sich besonders verschiedenartig verwenden und einbauen. Beim Benutzen und Einsetzen lassen sich unsre Lagerräume äußerst verschiedenartig veröden, was wir als langjähriger Lager & Containervermieter von Lagerraum, Lagercontainer, Selfstorage-Lagerraum wie auch Stauraum mit Vergnügen zeigen lassen.Als langjähriger Lager & Containervermieter von Lagerraum zeigen wir mit Vergnügen, dass sich unsre Lagerräume beim Verwenden und Einsetzen überaus facettenreich veröden lassen. Unsere Lagerräume lassen sich äußerst verschiedenartig veröden, was wir als langjähriger Lager & Containervermieter von Lagerraum, Stauraum, Selfstorage-Lagerraum, Lagercontainer gern zeigen. Überzeugen Sie sich von bester Güte bei unserem Lagerraum, Lagercontainer, Selfstorage-Lagerraum, Stauraum.

Aktenlager aus Rechtenbach vom Experten

Nicht bloß Qualität und Funktion sind wichtig, falls Sie Dokumente & Akten lagern erwerben. In unsrem Warenangebot finden Sie ein Vielzahl davon. Wir zeigen Ihnen mit Vergnügen, welche Variationen von Aktenlager es gibt! Welche Variationen von Aktenlager es gibt, zeigen wir Ihnen mit Freude! Die Telefon-Hotline ebenso wie das Kontakt Formular der Website sind tolle Optionen.

Aktenlager und Lagerbox in Rechtenbach gesucht? Selfstorage&Container ist Ihr Anbieter für Lagerboxen, Lagerräume oder Lagerplatz

Haben Sie einen Rechtenbacher Lager & Containervermieter aus dem Vorwahlbereich 09352 gesucht?

Möchten Sie mehr über uns wissen? – Jetzt direkt in Rechtenbach anrufen – Tel.: 09352 – 555664

Die Leistungen aus Rechtenbach (Bayern)

- Lagerbox für 97848 Rechtenbach, Lohr (Main), Neuhütten, Partenstein, Neustadt (Main), Wiesthal, Rothenbuch oder Frammersbach, Heigenbrücken, Weibersbrunn

- Lagerboxen für Rechtenbach

- Container in Bayern

- Lagerraum aus Rechtenbach – Neuhütten, Partenstein oder Lohr (Main)