✅ Lagerbox 86748 Marktoffingen – Selfstorage&Container.🙂

Herzlich Willkommen bei Selfstorage Container

WIR VERMIETEN: LAGERBOXEN & CONTAINER

WIR VERKAUFEN: CONTAINER & ZUBEHÖR

Unser Standort:

🔎 Container, Aktenlager, Lagerraum Profi in Ihrer Stadt gegoogelt? ✓ Willkommen bei uns. ★★★★★ Selfstorage&Container, auch in 86748 Marktoffingen sind wir für Sie da. Für Lagerbox, sind wir Ihr Lager & Containervermieter. Jahrelange Erfahrung macht uns aus

✅ Selfstorage&Container, Ihr Lager & Containervermieter für Lagerbox, Lagerraum, Container, Lagerplatz oder Aktenlager. ⭐ Melden Sie sich bei uns ✉ .

Lagerbox Marktoffingen: Lager & Containervermieter Selfstorage&Container bietet Ihnen Kompetenz und Erfahrung.

- Lagerbox, Möbellager

- Dokumente & Akten lagern, Archivdepot

- Lagerraum, Stauraum

- Lagerräume, Selfstorage-Lagerraum

- Lager & Container mieten, Materialcontainer

Sind Sie auf der Suche nach Lagerbox in 86748 Marktoffingen, Kirchheim (Ries), Ehingen (Ries), Unterschneidheim, Maihingen, Wallerstein, Fremdingen ebenso wie Nördlingen, Riesbürg, Munningen? Mit Selfstorage&Container haben Sie den richtigen Lager & Containervermieter für Lagerboxen in Ihrer Nähe gefunden.

- Lagerplätze, Lagerhalle mieten, Lagerflächen, Möbel & Inventar Einlagerung

- Lagerraum, Selfstorage-Lagerraum, Lagercontainer, Stauraum

- Lager & Container mieten, Containervermietung, Materialcontainer, Schnellbaucontainer

- Aktenlager, Archivdepot, Dokumentelagerung, externe Archivierung von Dokumenten

Wissenwertes über Lagerbox und Lagerraum, Container, Lagerplatz, Aktenlager sowie externe Lagerung von Akten

für Marktoffingen, Maihingen, Wallerstein, Fremdingen, Kirchheim (Ries), Ehingen (Ries), Unterschneidheim ebenso wie Nördlingen, Riesbürg, Munningen Marktoffingen sind Sie auf der Suche nach unserem Lagerbox?Sie lassen sich unsre Lagerboxen vorführen und sehen in unserem Unternehmen Selfstorage&Container vorbei.Was unsere Kunden von uns als kenntnisreicher Lager & Containervermieter unserer Lagerboxen erhoffen, wissen wir vollkommen. Zu einem äußerst erfolgreichen Preis- / Leistungsgefüge bieten wir Ihnen unser Lagerbox.Darüber hinaus bieten wir Ihnen eine weit auseinander gefächerte Reihe.In verschiedenen Branchen finden Sie unsere Lagerboxen.In Lagerraum, Container, Lagerplatz und Aktenlager geschieht die Kategorie Segmentierung.Wenn Sie unser Lagerbox bei uns erstehen, verlassen Sie sich hinsichtlich der Lagerboxen auf allerbesten Service und eine tolle Lieferung.

Günstige Lagerboxen aus Marktoffingen Minderoffingen, Ramstein, Wengenhausen und Schnabelhöfe -Toll dass Sie auf uns gestoßen sind

Wir haben für Marktoffingen Schnabelhöfe, Minderoffingen, Ramstein und Wengenhausen das Lagerbox, Möbellager, Lager oder Aktenlager zu bieten? Wenn Sie shoppen und nach den Lagerboxen suchen, besuchen Sie den Lager & Containervermieter Selfstorage&Container. Erfolgreich offeriert der Betrieb Selfstorage&Container Lagerräume, Lager & Container mieten, Dokumente & Akten lagern und Lagerplätze. Das Unternehmen offeriert schon seit mehreren Jahrzehnten Serviceleistungen mit innovativen Funktionen und hoher Qualität.

Lager & Containervermieter von Dokumente & Akten lagern aus Marktoffingen gesucht?

Lagerbox und Aktenlager in Marktoffingen gesucht? Selfstorage&Container ist Ihr Fachmann für Lagerräume, Lagerboxen sowie Lagerraum

Wir produzieren als erfahrener Lager & Containervermieter Dokumente & Akten lagern mit Vergnügen nach Ihren Wollen an. Es ist für uns problemlos möglich Aktenlager, Aktenlagerung, Archivdepot oder externe Archivierung von Akten als Individualanfertigung zu erstellen. Sie müssen uns nur sagen, was Ihnen bei Aktenlager, externe Archivierung von Dokumenten ebenso wie Archivdepot, Dokumentelagerung äußerst wichtig ist. Nicht allein bei Aktenlager und externe Lagerung von Akten und Archivdepot, Aktenlagerung, sondern ebenfalls bei weiteren Produkten, entspricht unser Betrieb Ihnen apropos mit Vergnügen Ihre Spezialwünsche.

Dokumente & Akten lagern, für Marktoffingen warten wir auf Ihre Sonderwünsche

Aktenlager, Aktenlagerung, Archivdepot wie auch externe Archivierung von Dokumenten können Sie nur verwenden, sofern es in einem Sondermaß angefertigt ist? Wir können Ihnen hierbei hilfreich sein. Unsere Dokumente & Akten lagern produzieren wir als fachkundige und kompetente Lager & Containervermieter nach Maß an. An uns können Sie sich ebenfalls wenden, für den Fall, dass Sie sonst noch Extrawünsche bei Aktenlager, externe Lagerung von Dokumenten oder Dokumentelagerung, Archivdepot haben. Zu einem äußerst guten Preis- / Leistungsverhältnis bieten wir Ihnen unsre Dokumente & Akten lagern an, obwohl die Dokumente & Akten lagern auf Traum Individualanfertigungen sind.

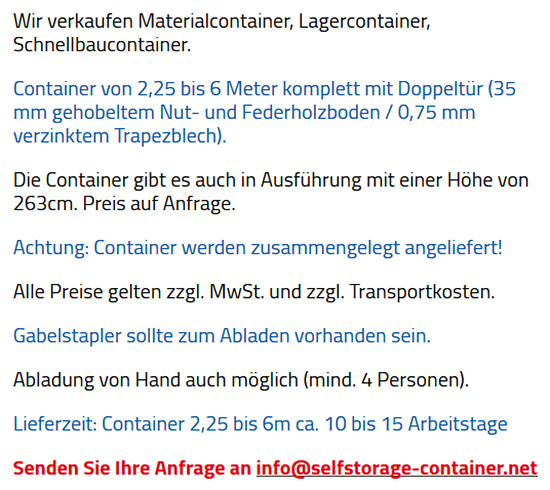

Container: Materialauswahl und Bearbeitung im Vordergrund.

- Container

- Schnellbaucontainer

- Containervermietung

- Materialcontainer

- Lager & Container mieten

Container und Lagerbox in Marktoffingen gesucht? Selfstorage&Container ist Ihr Experte für Lagerboxen, Lagerplätze und Aktenlager

Sie haben täglich schon ein Container, Schnellbaucontainer, Containervermietung, Materialcontainer gesucht, das Ihre individuellen Erwartungen vollkommen erfüllen kann. Genau auf Ihren Bedarf zugeschnitten können wir Ihnen als versierte Firma Lager & Container mieten anfertigen. Sich so abändern und anpassen, dass Sie für Sie noch besser verwendbar sind, lassen sich unsre Lager & Container mieten. Sie können als erfahrener Lager & Containervermieter von Container, Materialcontainer, Containervermietung oder Schnellbaucontainer mit Ihren Sonderwünschen gleich zu uns kommen. Um unsre Lager & Container mieten Ihren Ideen anzupassen, nehmen wir uns gern die Zeit. Sie teilen uns einfach mit, wie Sie sich unsre Lager & Container mieten wünschen.

Container, Containervermietung, Materialcontainer und Schnellbaucontainer, hochwertige Verwendungen in Marktoffingen.

Ihre ganz individuellen Wünsche sollen durch Lager & Container mieten erfüllt werden? Als erfahrene Lager & Containervermieter offerieren wir Ihnen unser Container, Schnellbaucontainer, Materialcontainer, Containervermietung so, wie Sie es sich wollen. Persönliche Wünsche betreffend Container, Schnellbaucontainer oder Containervermietung, Materialcontainer? Wir erfüllen es mit Vergnügen als professionelle Lager & Containervermieter.

Lagerraum, ansprechende Verwendungsmöglichkeiten aus Marktoffingen.

Lagerbox oder Lagerraum in Marktoffingen gesucht? Selfstorage&Container ist Ihr Profi für Lagerboxen, Lagerplätze und Container

Lagerraum, Selfstorage-Lagerraum, Lagercontainer, Stauraum ist ein Produkt mit besonders erfolgreichen Dienstleistungen. Sie werden keinerlei Dienstleistungen mit besseren Merkmale entdecken. So haben die Services zahlreiche erfolgreiche Qualitätsunternehmen überzeugt. Dies verhalf des Unternehmens zu einem der vorderen Plätze in der Produktkategorie.

Lagerraum, Stauraum, Lagercontainer, Selfstorage-Lagerraum, beachten Sie unsere Angebote für Marktoffingen.

In einem ungemein gehobenem Design bieten wir Ihnen unsere Lagerräume als kompetenter Lager & Containervermieter. Design ist bei unsrem Lagerraum, Stauraum oder Lagercontainer, Selfstorage-Lagerraum mit Durchführbarkeit vereint. Unsre Lagerräume wirken also sehr zweckmäßig und überzeugend. Bestens kann das schlichte Design der Lagerräume mit zusätzlichen Stilarten kombiniert werden. So können Sie Ihr Lagerraum und Stauraum ebenso wie Selfstorage-Lagerraum, Lagercontainer sehr vielseitig installieren und benutzen. In allen Kategorien überzeugen unsere Lagerräume, nicht nur in der Erscheinung. Genauer an sehen Sie sich die Details zu einem Lagerraum, Selfstorage-Lagerraum, Lagercontainer und Stauraum. Dann werden Sie ganz genau die Lagerräume entdecken, die Ihren eigenen Wunsch erfüllen.

Lagerplätze, ebenso für 86748 Marktoffingen erhältlich

- Lagerplatz

- Lagerflächen

- Möbel & Inventar Einlagerung

- Lagerplätze

- Lagerhalle mieten

Lagerbox und Lagerplatz in Marktoffingen gesucht? Selfstorage&Container ist Ihr Experte für Lagerräume, Lagerboxen sowie Aktenlager

Lagerplätze können nur in diesem Fall wirklich in der Nutzung überzeugen, für den Fall, dass sie anpassbar konstruiert sind. Alle Möglichkeiten, die Sie sich jederzeit gewünscht haben, finden Sie bei unserem Lagerplatz, Möbel & Inventar Einlagerung, Lagerflächen, Lagerhalle mieten. Ihnen offerieren unsere Lagerplätze die flexiblen Bauweisen, die die Anwendung komfortabel werden lassen. Selber überzeugen Sie sich, welch gutes Preis- / Leistungsverhältnis Sie bei unserem Lagerplatz, Möbel & Inventar Einlagerung, Lagerflächen, Lagerhalle mieten entdecken. Nicht nur durchgeplant aufgebaut ist das Lagerplatz, unsre Lagerplätze offerieren Ihnen ebenso aller besten Komfort.

Lagerplätze in zahllosen Variationen in Marktoffingen

Marktoffingener Lager & Containervermieter aus dem Raum 09087 gesucht?

Überzeugt von uns? – Jetzt direkt in Marktoffingen anrufen – Telefon: 09087 – 555116

Die Leistungen in Marktoffingen (Bayern)

- Lagerboxen aus 86748 Marktoffingen Ramstein, Schnabelhöfe, Wengenhausen, Minderoffingen

- Lagerraum für Marktoffingen – Schnabelhöfe, Minderoffingen, Ramstein und Wengenhausen

- Lagerplatz DON, NÖ

- Container in Bayern

- Lagerbox in Marktoffingen, Kirchheim (Ries), Ehingen (Ries), Unterschneidheim, Maihingen, Wallerstein, Fremdingen und Nördlingen, Riesbürg, Munningen

- Aktenlager im Großraum 86748, , /

Informationen über Marktoffingen

Marktoffingen ist eine Gemeinde im schwäbischen Landkreis Donau-Ries und ein Mitglied der Verwaltungsgemeinschaft Wallerstein.